Coffee is the second most imported commodity in the world beaten only by oil. Coffee is one of the most interesting, yet volatile commodities to trade. Coffee is prone to wild swings in price, and traders must consider a variety of factors about coffee production and demand when making decisions regarding coffee futures.

So what are the main drivers of the coffee market? Who moves the coffee markets? How to prepare for the challenges of the C market?

We were able to convince our seasoned veteran of the coffee trade -and CEO of the EFICO GROUP– Michel Germanès to briefly step off the trading floor to demystify and clarify this tricky commodity. Michel has been keeping an eagle eye on the daily coffee market for over 40 years; he truly knows the ins and outs of the coffee bizz. Michel is the perfect person to sketch the coffee market and prices, to illustrate and clarify the current situation, and to provide some smart advice to the roasters.

MAPPING THE COFFEE MARKET

- Coffee is one of the most traded commodities worldwide. It is derived from a plant grown in more than 40 countries, all with tropical and subtropical climates. Brazil is the world’s leading coffee producer, accounting for around 39% of global supply. The other top producers include Vietnam, Colombia, Indonesia and Ethiopia.

- Many coffee traders focus on Brazil; the largest coffee exporting nation is expected to reach 55 million 60-kg bags in 2023, a 7.9% increase from the previous year.

- There are two major types of coffee traded worldwide: Arabica and Robusta. These two coffee types differ in crucial ways and respond to different triggers.

- Coffee futures are traded on different exchanges. The two major global exchanges are ICE in New York (also known as the C market), which trades Arabica, and LIFFE in London for Robusta. The ICE and LIFFE set the price of coffee, which is known as the C price. They also stipulate that Arabica green coffee can only be traded in lots of 37,500 lbs, and one lot Robusta is equivalent to 10 metric tonnes.

WHAT MOVES COFFEE PRICES ?

Coffee is the second most imported commodity in the world beaten only by oil. Coffee is quite volatile in the commodity markets because of some critical factors. Global events -from weather to politics and economics- can have a profound impact on the price of coffee. Let’s take a look at some of the main price drivers:

CLIMATE

In addition to being the biggest global producer, Brazil is also the only major coffee producer subject to frost risk.

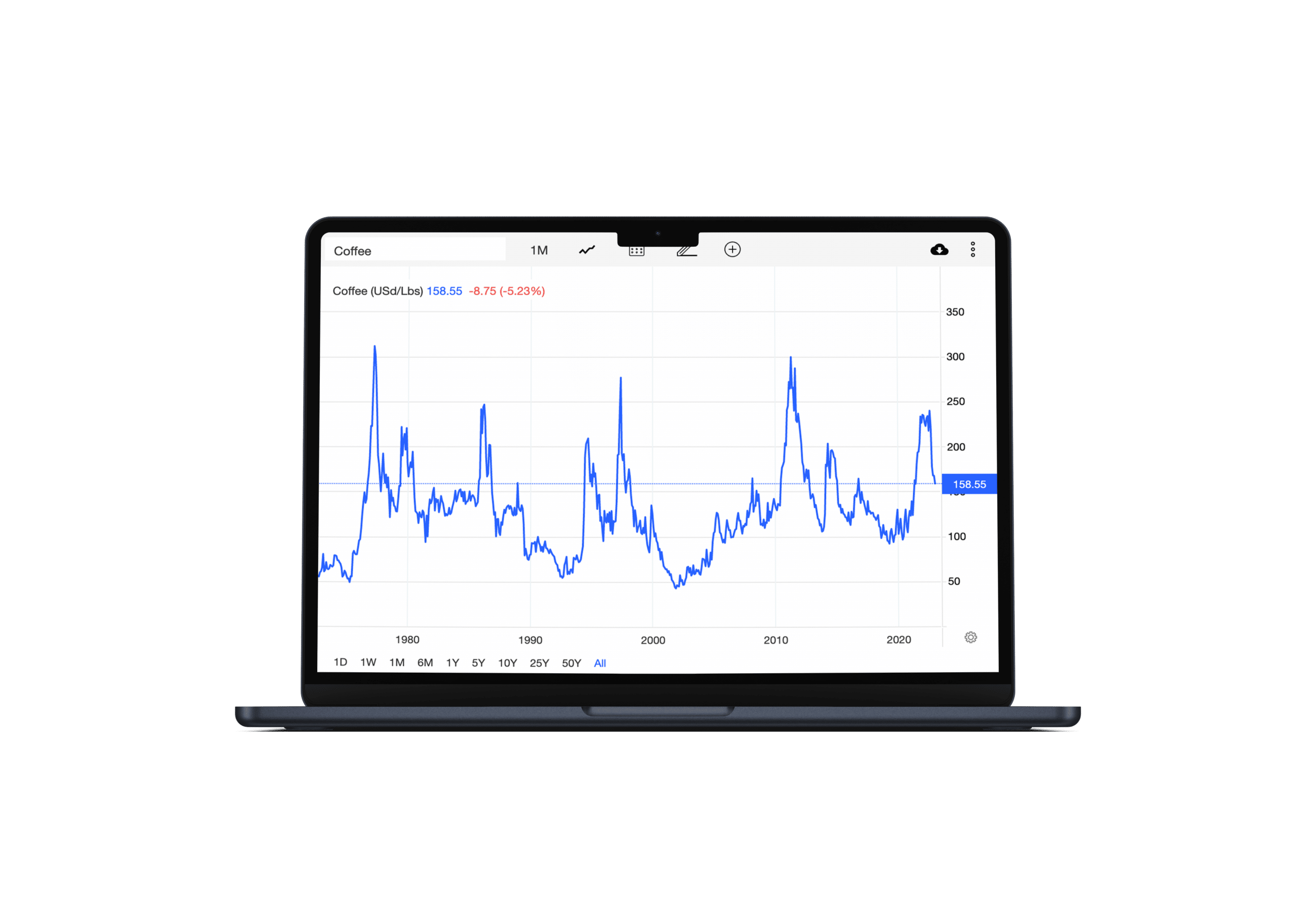

For example, the 2021 frost in Brazil increased prices to levels not seen since the mid-90’s when Brazil last had a black frost event on this scale. Usually, the summer months in Brazil bring the much-needed nourishment for a fructuous crop, but in 2021 the rains never came. And if a long drought weren’t enough, a severe wave of frost hit the regions in July ‘21. Couple tough weather with backlogged shipments due to Covid-19 restrictions and a lack of in-person people-power, and you get a decline in supply for one of the world’s most profitable commodities. Due to expected rarity, Arabica coffee peaked at 150 US cents/lb in July 2021, the highest price per pound since November 2014, and continued to rise to 260 US cents/lb.

PLANT DISEASE

Agricultural commodities are also affected by other risks that can influence the condition of plants, such as disease. ‘Coffee leaf rust’ is a disease caused by a fungus that can devastate coffee crops. Robusta beans are more resilient than Arabica beans, which are more delicate and susceptible to damage from bad weather or disease. For example, global coffee prices rose sharply in 2013 after coffee leaf rust damaged crops in Central America and reduced supply. It was estimated that around 70% of Guatemala’s coffee production was affected.

GEOPOLITICS

As more than 90% of coffee is produced in developing countries, social unrest or political instability can disrupt coffee production and market sentiment. Futures prices respond quickly to geopolitical events in major producing nations.

For example, with Russia being the world’s sixth largest coffee consumer, the war in Ukraine and resulting sanctions has had an impact on coffee demand, and is expected to cause a supply surplus in the 2022 to 2023 growing season. In coffee powerhouse Brazil on the other hand, supporters of former President Jair Bolsonaro raided the presidential palace, congressional and supreme court offices in Brasilia on January 8, 2023. The riot is part of a broad crisis of confidence; public suspicion of the country’s establishment has reached its peak. Such riots, large-scale demonstrations and crippling strikes cause economic and political damage at the very least.

TRANSPORT COSTS

The cost of transporting coffee around the world is factored into prices. Costs for fuel and shipping determine how expensive it is to distribute coffee. During the Covid-19 pandemic, high freight costs contributed to prices reaching decade highs.

U$ DOLLAR

Commodity markets including coffee are often priced in US dollars, so the value of the dollar also affects prices. Dollar-denominated commodities become more expensive for buyers with other currencies when the dollar rises, which can weigh on demand. Meanwhile, coffee becomes cheaper when the dollar falls, increasing international demand.

INCREASED CONSUMER DEMANDS

The demand side also plays a large role in the price of coffee. According to International Coffee Organization, global consumption of coffee is likely to climb by 1% to 2% a year through the end of the decade. There is a catching up movement in coffee producing countries; in recent years they too have been consuming more and more coffee.

AND LAST, BUT CERTAINLY NOT LEAST – TECHNICAL SPECULATION

There are two main types of speculation. The first is ‘fundamental speculation’ which relates to the physical supply and demand dynamic in a specific market, i.e. coffee (read above). The point to underline here is that shifts in physical supply and demand should be self-correcting over time. But concerns like weather or production are no longer the biggest factors driving daily market volatility so the industry endures many false signals! This leads us to ‘technical speculation’, or trading based on market chart patterns formed by the actions of other traders. These days, a majority of technical speculation is conducted by computers trading based on algorithms, in milliseconds. Typically market liquidity serves to smooth out volatility, but when high frequency trading is involved, things get disco. Their numbers are increasing, the market becomes circular and self-referencing and runs the risk of disconnecting from physical supply and demand concerns altogether…

Technical speculation is the cause of extreme price volatility in the coffee market and it is a symptom of an issue within a much bigger system. Coffee-industry veterans blame financial investors (large financial institutions such as hedge funds, proprietary trading firms, and mutual funds). They say they’re taking advantage of global supply hiccups to drive up coffee prices by adding volatility to the trading of contracts for future delivery of coffee.

NAVIGATING THE C-MARKET – FINAL THOUGHTS & TIPS

Most coffee aficionados understand the ‘macro’ steps of coffee (a farmer grows coffee, then that coffee must be roasted before brewing according to your chosen method), minus the technical details (e.g., processing methods, roasting curves, extraction yields,..). But when it comes to the role of the C-Market and how green coffee is bought, it’s not as simple. Luckily we found Michel Germanès, our inhouse seasoned coffee trader, ready to explain and illustrate the mechanics of this C-Market.

Michel, what are the mechanisms of this coffee ‘C-Market’ ?

“If you’ve ever purchased green arabica coffee beans, the price you paid will have been determined, at least in part, by what’s known as the ‘C-Market’“, Michel starts off. “What the ‘C-Market’ is based on is not what the cost is ‘Per Pound’, but your cost calculation is linked to the market changes.” Michel explains: “The price of coffee changes every minute like stock- or any other commodity- does. It’s defined by commodities exchanges, including the Intercontinental Exchange (ICE) in New York, which is the most important for Arabica coffee and which sets what’s called a ‘C–Price’. And, like any other exchange-traded commodity, stock, bond, currency, etc., this C-Price is defined by supply and demand. If there’s little coffee available, the cost goes up to the point at which supply exactly equals demand. Some people that had wanted coffee will decide not to buy as the price goes too high for them. The price will then stop increasing when the remaining people who are willing to pay want the precise quantity offered. This tendency for demand to change as price changes is called ‘price elasticity of demand’, and it’s the market’s unique price sensitivity.”

“To understand the C-Market fully”, Michel continues, “you need to understand its contracts. Most of the activity in the C-Market revolves around ‘futures contracts’. A futures contract is a legal agreement in which the buyer agrees to purchase a commodity at a predetermined price at a specified time in the future when the contract expires. The seller of the contract agrees to provide the specified commodity at the expiration of the contract. The basic unit of a coffee futures contract is 37,500 pounds of coffee. Pricing for futures contracts is based on the commodity market price, so futures are an important way for coffee roasters and importers to hedge and protect their business; locking in contracts when prices are low to protect against inevitable spikes in coffee price is a common strategy. It’s important to note that when a roaster or importer buys a futures contract, the physical asset being delivered (i.e., the coffee itself) often does not exist yet. It is thus quite common for roasters to book contracts several months in advance if prices are favourable, thus making coffee futures as much about playing the market as they are about actual product.”

“Sounds easy, no?”, Michel laughs, “but it is about to get a bit more confusing… So the agreed-upon price is based on the predicted price (which in turn is based on supply and demand) at the delivery date when the contract expires. For example, if people think the C-Price will increase in the future due to supply and demand conditions, such as a weak harvest in Brazil, they’ll start buying futures contracts today to sell for a profit when and if the price increases as the delivery date approaches. That increased demand for coffee contracts will cause the current price to go up. The reverse is also true. If there is speculation that the price will drop, people will start selling their coffee and futures contracts or take short positions. This decreased demand will cause the current price to drop based on future speculation. If there’s a lot of coffee available, however, the price will fall to the point at which it’s all sold. So there’s more available than people want that day but, as the price drops, they decide to buy more to take advantage of a good deal. The price stops dropping at the moment that people agree to purchase precisely the quantity offered.” “These futures contracts”, Michel continues, “are standardised in terms of the quality and quantity of a given commodity. Because of this, the futures price is representative of a typical range of qualities of commodities, and therefore is an average price.”

“Now you may be thinking ‘Not all coffee tastes the same so surely it’s not all priced the same?’. That is where the differential comes in to play”, Michel clarifies. “The price specific to origin and quality (of any product) is indeed not always the same; it may be higher or lower. The premium or discount of the physical product, the differential, represents the value the market attaches to the product, plus or minus, depending on price/quality. Basically it is important to understand that the C-Price acts as a reference; it is the exchange price, which is determined in real time by the execution of transactions. These transactions are simply people buying and selling contracts from each other, with the exchange facilitating the deal.” “But,” Michel emphasizes once again, “it is not the final price paid for a coffee, but rather a portion of it. Various differentials can be added based on a particular country’s system, physical coffee quality and certification such as Organic or Rainforest Alliance.”

“As said before”, Michel continues, “the C-price is affected by a range of factors, including speculation, quality of harvests and farmers abilities to get their coffee to the market. But it is also important to know what is happening in a country on a social, economic, political, monetory,.. level. Sometimes, intel that is relating to 3, 6, or 12 months down the line is also being factored into the price“. He continues: “Several times a day we review the state of affairs with our sourcing offices and trading team. Not only are we up-to-date every moment of the day, but thanks to our local representatives we can also know what to expect 3, 6 or even 12 months ahead of time.”

“Precisely because there are so many different influential factors, it can happen that the market changes 20% within a week. This always depends on harvest expectations and global demand. The C-price is known to be volatile by nature and historically it has remained below $2/lb, and on some occasions dropped down to $1/lb. The fluctuations and low prices make it difficult for producers to sustain their livelihoods and extremely hard to plan ahead or make investments on their farms.”

Michel, do you have some final advice for the roasters ?

“Think of the futures price as a barometer for your decision making. Is the market down? Well, it probably means there is a decent amount of supply in the market. Does the market look like it’s heading up? Maybe think about booking coffee forward to protect your costs.”

Michel adds: “It’s also advisable for roasters to be open to other coffee origins as substitutes should any supply issues arise. This will help to mitigate some of the market constraints.” “But the most important thing I can say now”, he concludes,” is to be ready to make decisions.” “If the market hits a certain level that works in your budget, make a decision in a day, because the market may not stay there. If the price is right for you* and it is the right quality, don’t hesitate, decide right away. Buy even more, just to be sure.”

When looking at recent consumption trends, Michel says that demand for coffee is still on the rise. “According to International Coffee Organization, global coffee consumption is likely to climb by 1% to 2% a year through the end of the decade, estimated about 25 million more 60-kilo bags will be needed over the next eight years.

Michel ends with a little rethorical question: “The ‘C’ in ‘C-Market’, you probably think it stands for ‘coffee’ or ‘commodity’ but actually it refers to ‘centrals’. The modern C-market we know today was established in 1968-1969 by Central American producers who wanted to differentiate their prices, mostly from Brazilian beans. Before the C-market, Arabica coffee was traded under the Universal or ‘U’ contract. Today, coffee-producing countries around the world trade their Arabica beans on the C-market, not just those from Central America.’

“The most important thing I can say now is to be ready to make decisions.

If the market hits a certain level that works in your budget, make a decision in a day, because the market may not stay there.”

“Ultimately”, Michel states “having a clear understanding of your business model and needs, coupled with the curiosity to continuously seek out new knowledge and info, can help guide roasters to make strategic decisions in these unprecedented times. Forecasting markets involves so much analysis and interpretation, your sources and intel matter.”

↦ For those interested in following the market and learning more about market analytics, you may want to subscribe to our daily market report.

“It is also crucial for roasters to communicate expectations to producers or importers when procuring coffee, so that both parties can figure out the best way to move forward in these times of uncertainty. For instance, ask yourself whether you need the coffee to add acidity, body, or to lower the cost of a blend”, Michel concludes. “Please remember that when it comes to how the market impacts your business and buying options, we’re always here to answer any question you may have.”

↦ You can schedule in-person meetings with our trading team in our offices, at conferences or events. Or you can book a telephone/video call.

ACKNOWLEDGEMENTS & REFERENCES

Michel Germanès, CEO EFICO Group

Intercontinental Exchange. “Coffee C Futures.”

U.S. Department of Agriculture. “Coffee: World Markets and Trade,” Page 6 & 9

iPath. “iPath Series B Bloomberg Coffee Subindex Total Return SM ETN.”

World Population – Coffee Facts & Figures

Trading Economics – Coffee Markets