BRAZIL COFFEE HARVEST UPDATE 2025/2026

Brazil 2025 Harvest Report – Insights for Roasters

There’s an old saying in the coffee world:

“When Brazil sneezes, the rest of the coffee world catches a cold.”

The expression holds true. Accounting for 35-40% of global coffee production, Brazil is the single most influential coffee origin in shaping supply, pricing, and even the flavour profiles available worldwide. In some years it provides stability; in others, it drives volatility across the entire industry.

History has shown this time and again. The devastating frost of 1975 sent prices soaring, while the droughts of 2014 and 2021 left exporters scrambling to fulfil commitments. On top of this, countless currency swings have reshaped contracts and trade dynamics far beyond Brazil’s borders. Simply put: what happens in Brazil resonates across the global coffee sector.

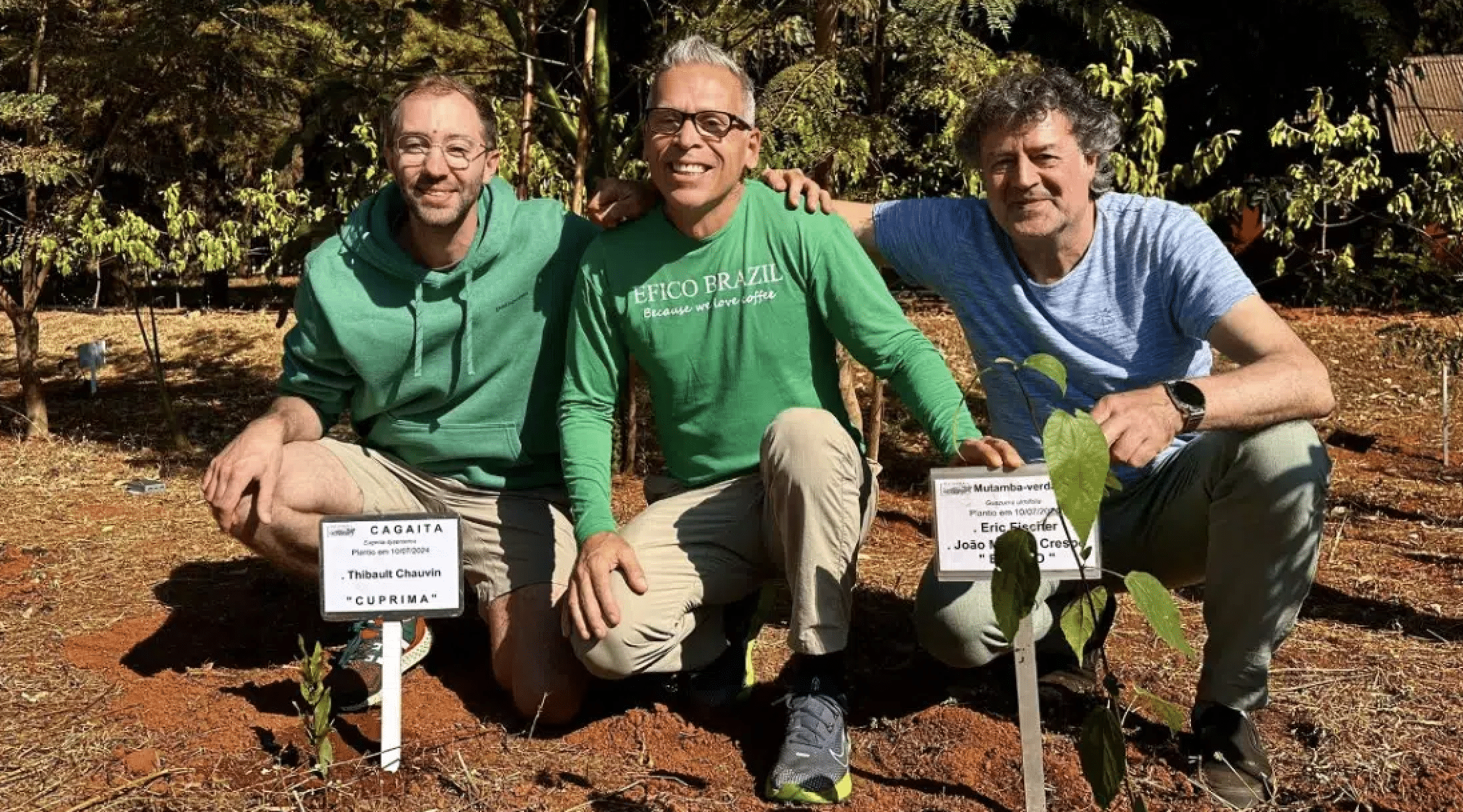

This is precisely why EFICO maintains a strong presence in Brazil’s coffee heartlands. With a dedicated origin office, regular farm visits, and long-term partnerships with producers, our teams engage directly on the ground- walking the fields, listening to growers, and building trust over time. These close connections ensure that our sourcing strategies, and the insights we share with partners, are rooted in authentic, first-hand experience. To complement this, our green coffee traders join annual field trips across Brazil, deepening market understanding and reinforcing relationships with the people and communities behind every harvest.

So what does the Brazilian 2025/2026 harvest look like?

Harvest Progress & Crop Outlook

By the end of August, the 2025 harvest was 99% complete, with 100% of robusta and 98% of arabica collected. Despite episodes of rain-up to 50mm in some Arabica regions and 30mm in Robusta zones -bean development has been strong. Average screen size is above last year’s levels, and the mild winter climate extended the processing window, enabling greater volumes of washed and semi-washed coffees. Light frosts in late June caused only minor localised impact.

The 2025/26 crop is projected at 62.3 million bags, down 3.4% from earlier estimates and 5.4% year-on-year. Arabica is expected at 36.5 million bags (–18.4% YoY), while robusta is forecast at 25.8 million bags (+21.9% YoY). Strong post-harvest vegetation signals high potential for the 2026/27 cycle, with nurseries already sold out and farmers reinvesting heavily in renewal and expansion.

Regional Insights

Beyond the headline numbers, South Minas and the Cerrado showcase distinct approaches, yields, and innovations -insights our EFICO teams gathered firsthand during multiple visits.

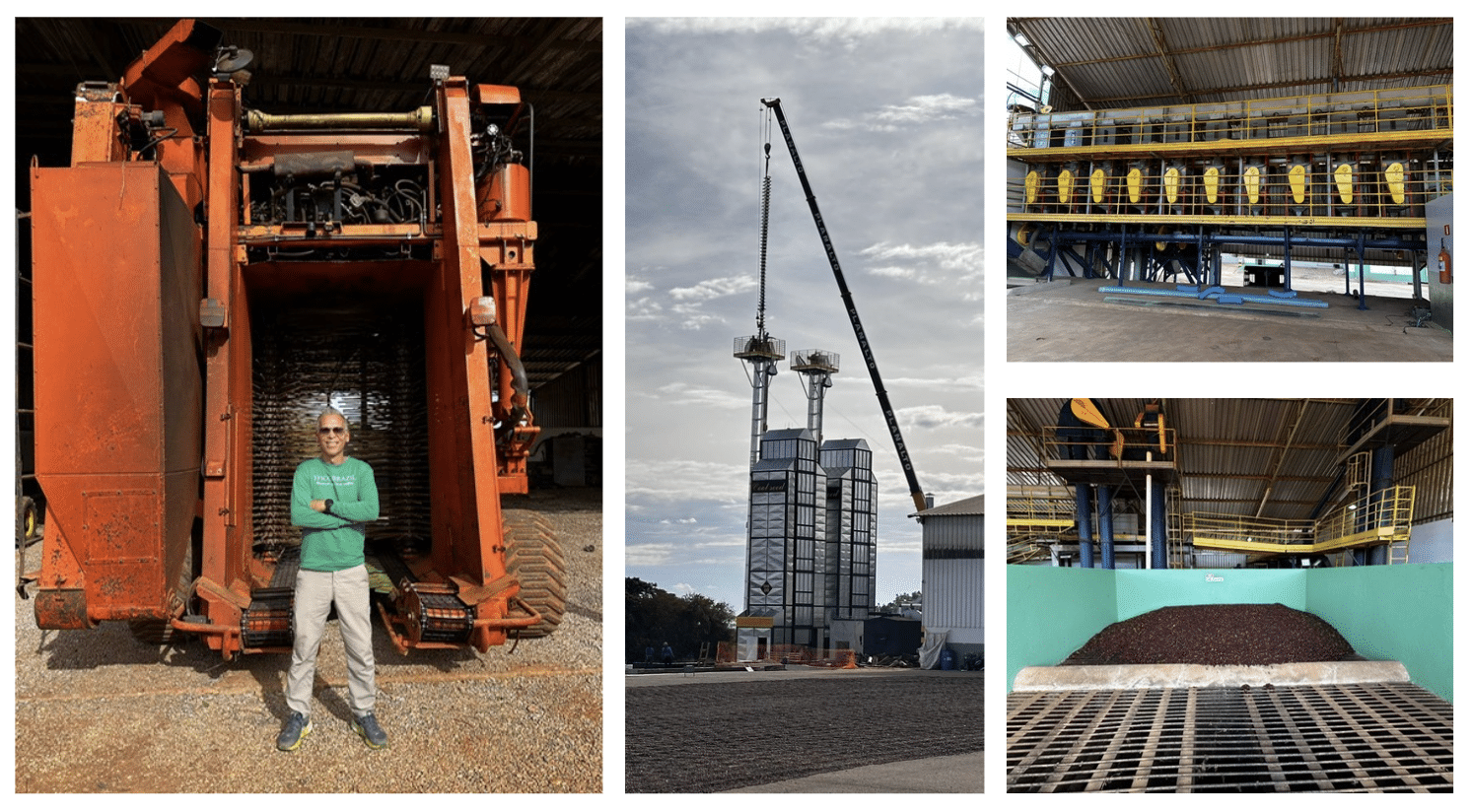

South Minas Gerais is arguably the largest coffee-producing region in the world, spanning 500,000 hectares. Key cities include Varginha, Três Pontas, Poços de Caldas, and Guaxupé, with altitudes ranging from 850 to 1,250 meters and average productivity around 25 bags per hectare, in line with the national average. Across five visits this season, EFICO observed wide variations in farm productivity, with some performing far below average while others excelled. One constant was investment: innovation in warehouses, adoption of new technologies, and test plots with irrigation, enabling more precise fertiliser application and improved yields.

The Cerrado, or as EFICO Brazil director João Marcos Crespo calls it, ‘The Factory’, is a region where every detail is meticulously planned. Farms are larger than in South Minas, with many ‘small’ farms comparable to medium-sized ones in the South. Spanning nearly 250,000 hectares, over half irrigated, altitudes range from 800 to 1,200 meters. Average productivity reaches 35 bags per hectare, yielding roughly 6 million bags per crop.

The most important news here is that regenerative agriculture is everywhere. Farmers consider it a better and cheaper way to supply nutrients and relieve the soil. Also important to mention are the new mechanical dryers (like towers), which have twice the capacity of conventional dryers.

Market Observations & Crop Overview

This time of year naturally raises questions for the market. In some regions, smaller beans or reduced yields could affect final numbers, while other areas continue to offer a steady flow of standard screen sizes. Overall, 2025 has been another challenging year, yet Brazilian producers remain financially strong, carefully releasing coffee in small lots and waiting for the optimal moment to sell.

The complexity of the market has been heightened by the introduction of 50% import duties by the U.S., which came into effect on August 1, adding further uncertainty to price developments. At the same time, commercialisation is at its lowest level in five years, prompting exporters to manage both sales and procurement more carefully while closely monitoring flows to the market.

In summary, Brazil’s 2025 crop presents a decent-sized harvest of 60-62 million bags. Investments in quality and innovation continue to drive improvements, with screen sizes generally above last year’s levels. Market volatility is expected to persist at least through September and October, as flowering and rainfall patterns for 2026 will determine the outlook. Meanwhile, low commercialisation and a focus on nearby exports remain key features shaping the current market.

Final Thoughts

Brazil remains the heartbeat of the global coffee trade. Whether in the innovation-driven Cerrado or the tradition-rich South of Minas, this year’s harvest reflects a sector that is modern, resilient, and still deeply influential.

And as always: when Brazil sneezes, the rest of the coffee world feels it.

The new harvest will be arriving in early October. Contact EFICO’s green coffee traders for pricing, availability and booking opportunities.

NOTES, CREDITS, REFERENCES

Thank you, João Marcos Crespo, Director of EFICO Brazil, for sharing your firsthand information