EFICO GREEN COFFEE TRADERS’

FIELD REPORT

GUATEMALA & EL SALVADOR

Harvest, Quality & Market Insights

Boots On the Ground – A Chat with EFICO’s Green Coffee Traders

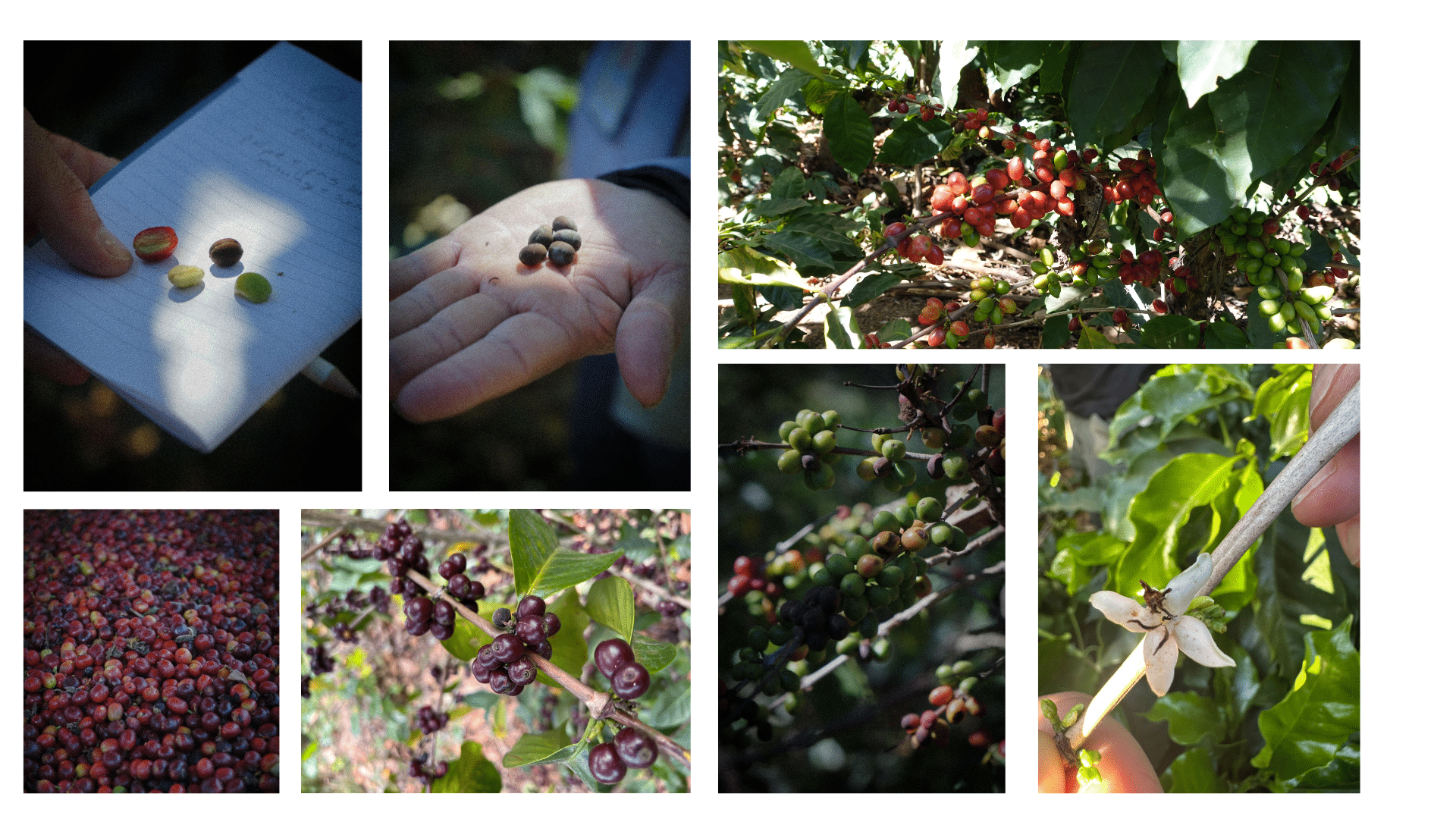

Thomas: ‘During our visit, we took note of the key coffee varieties grown in each region. In Guatemala’s Atitlán region, we mainly saw Caturra and Catuai, while in Antigua, Bourbon dominated. In El Salvador, Bourbon remains the primary variety, along with hybrids like Mundo Novo, Pacas, and Pacamara.’

Nicholas: ‘Despite their different histories and production styles, Guatemala and El Salvador now face a common challenge –erratic weather patterns. Erratic rainfall, temperature swings, and soil degradation are impacting both the quality and volume of their harvests. To navigate these changes, adaptability at every stage -from farming to processing, is more essential than ever to ensure consistent yields and high-quality coffee in the years ahead.’

Can you give us a ‘Field Update’ and ‘Quality Outlook’ for Guatemala & El Salvador?

Nicholas: ‘This year’s Central American harvest is running about three weeks late, thanks to erratic weather -too much rain at the wrong time, not enough when it mattered. A drought during flowering was followed by excessive rainfall during ripening. When we visited in late January, warehouses were still nearly empty.’

Thomas: ‘One of the biggest concerns we noticed was the high number of unripe cherries -greenish and light reddish, mixed in with the ripe ones drying on patios. This uneven ripening is a direct result of inconsistent weather and a growing shortage of pickers, as many workers have migrated elsewhere

Renaud: ‘Labour shortages are a serious issue. In the past, pickers would go through the fields up to 5 times, harvesting only fully ripe cherries. Now, with fewer workers available, many farms are forced to limit picking to just 2 rounds. That means ripe and unripe cherries are collected together, as leaving fruit on the trees simply isn’t an option.’

Thomas: ‘That puts extra pressure on post-harvest processing. Farmers and mills are relying more on mechanical sorting to compensate for the labour gap and maintain quality. Another challenge is reduced fertilisation -rising costs have forced some farmers to cut back, which could impact yields and cup profiles in the long run.’

Renaud: ‘Coffee yields depend heavily on proper nutrition management. Ideally, farms should apply fertiliser 3 times per production cycle to maintain healthy yields. But with rising costs, many farmers have cut back to 2 or even just 1 application, which doesn’t just affect the current harvest -it also weakens the next cycle as nutrient depletion worsens. This issue is particularly pressing in Guatemala, where over 100,000 smallholder farmers cultivate less than 2 hectares of coffee. While many are turning to organic composting, overall yields are still declining. As a result, farmers are on the lookout for affordable technologies to support pruning, harvesting, and milling.’

Renaud: ‘Another major concern we observed in the field is early flowering, triggered by unexpected December rains. If no additional rainfall follows soon -which is unlikely during the dry season, these flowers will wither instead of developing into cherries. Once a flower bud is lost, it won’t regenerate in the next cycle, directly reducing the potential yield for the 2025/26 harvest.’

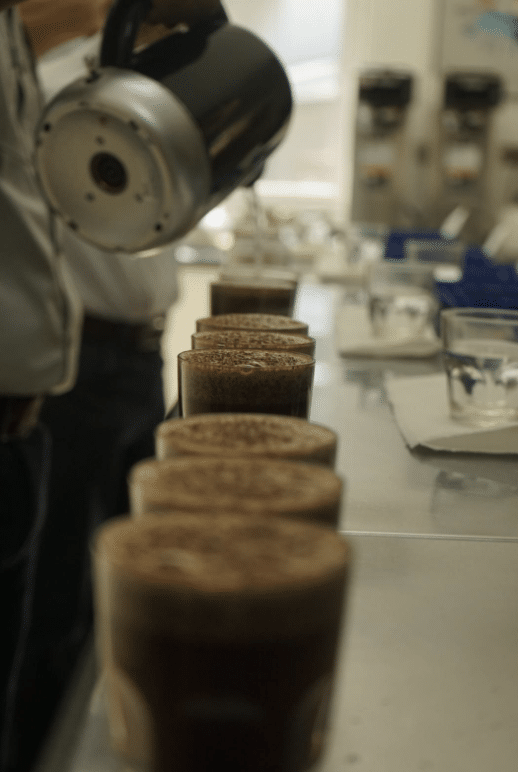

Nicholas: ‘The good news is that the intrinsic quality of the 2024/25 harvest looks strong –all our cuppings have been promising. However, maintaining that quality requires extra effort at the processing stage. More flotation at wet mills, density sorting at dry mills, and careful drying are all essential to compensate for uneven ripening and fewer picking rounds.’

Renaud: ‘Producers are navigating the usual challenges -labour shortages and unpredicatable weather, but they are adapting. In both countries, we’re seeing a strong commitment to careful processing and maintaining quality.’

How Are Climate and Logistics Shaping the Trade Outlook for the 2024/25 Guatemalan & El Salvador Harvest?

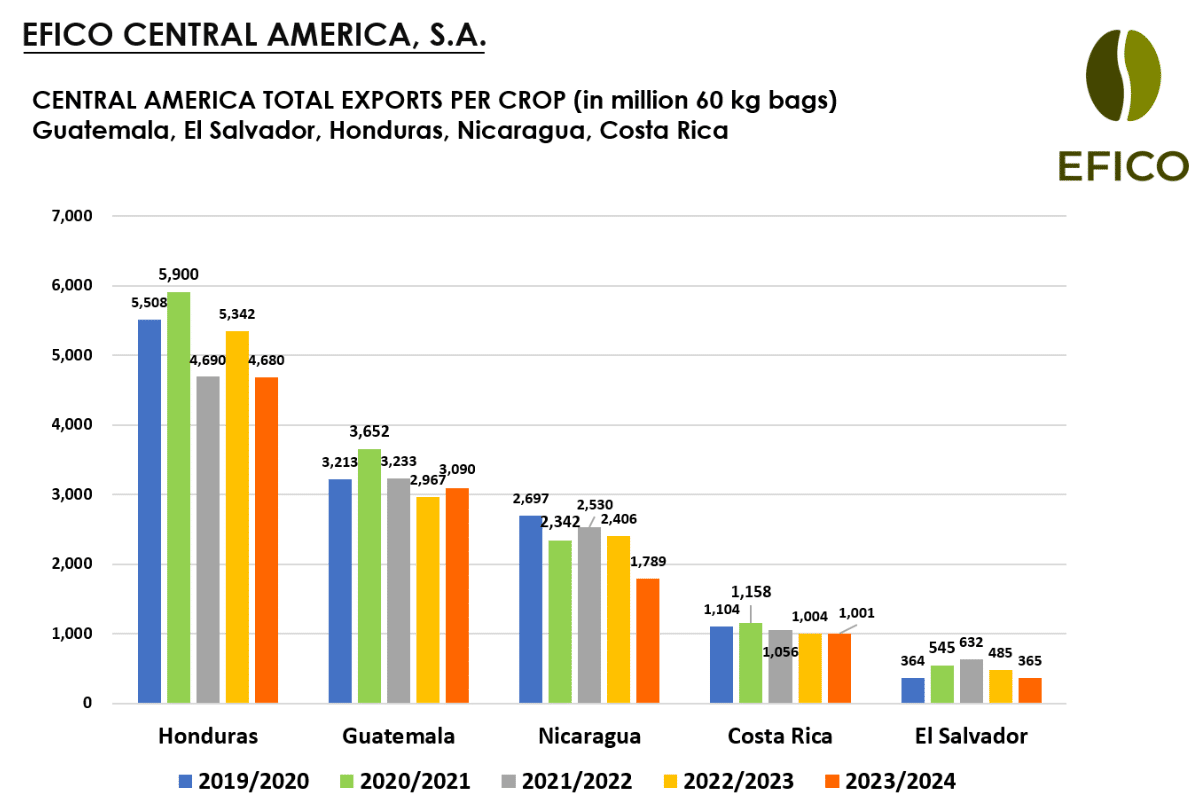

Renaud: ‘Guatemala’s production is holding steady at an estimated 3.25 million bags (60 kg), while El Salvador is seeing slight growth, reaching around 550,000 bags. Despite climate challenges and logistical hurdles, both countries are pushing forward.’

Nicholas: ‘When discussing trade, logistics also come into play. Port congestion and higher freight costs may affect shipping schedules, so roasters would be wise to plan ahead.’

What are the Key Takeaways for Roasters?

Renaud: ‘Arrivals will be slightly later this year, with coffees expected to reach SEABRIDGE by March 2025.’

Thomas: ‘The quality is looking great. Careful post-harvest processing will ensure the final coffees meet the high standards our roasters expect.’

Nicholas: ‘Though this year’s harvest took its time, we’ve secured excellent coffees from Guatemala and El Salvador. Let’s discuss what fits your needs!‘

NOTES, KUDO’S, CREDITS, REFERENCES & INSPIRATION

A huge thank you to our Central American team for their invaluable insights and field support. Having a local foothold makes all the difference -staying connected with producers, understanding market movements, and ensuring our partners have access to the best quality coffee, no matter the challenges. Gracias!

Photo credits: EFICO team & Terry Dauvier-Thibault

CUPRIMA – Navigating Central America’s New Crop & Climate Patterns

USDA & GAIN – Coffee Annual Guatemala & Coffee Annual El Salvador