HOW THE EU’S ORGANIC REGULATION UPDATE AFFECTS COFFEE VALUE CHAINS

Over the past few years, the coffee sector has faced unprecedented turbulence. Climate shocks, crop diseases, market volatility, and historic price fluctuations have reshaped the landscape for both coffee farmers and roasters.

Against this backdrop, the European Union has been updating several regulatory frameworks affecting coffee imports. The EU Deforestation Regulation (EUDR) seeks to ensure that sourcing does not contribute to deforestation, while mandatory Due Diligence legislation introduces responsibilities for actors across the supply chain. These measures are part of a broader push for transparency, sustainability, and social responsibility.

Adding to these developments, the EU’s organic legislation (Regulation EU 2018/848), which came into full effect on October 1, 2025, harmonises rules for organic certification across all imports, replacing the previous equivalency system for non-EU countries and establishing a new standard for certified organic coffee entering the EU market.

Organic coffee in a Challenging EU Landscape

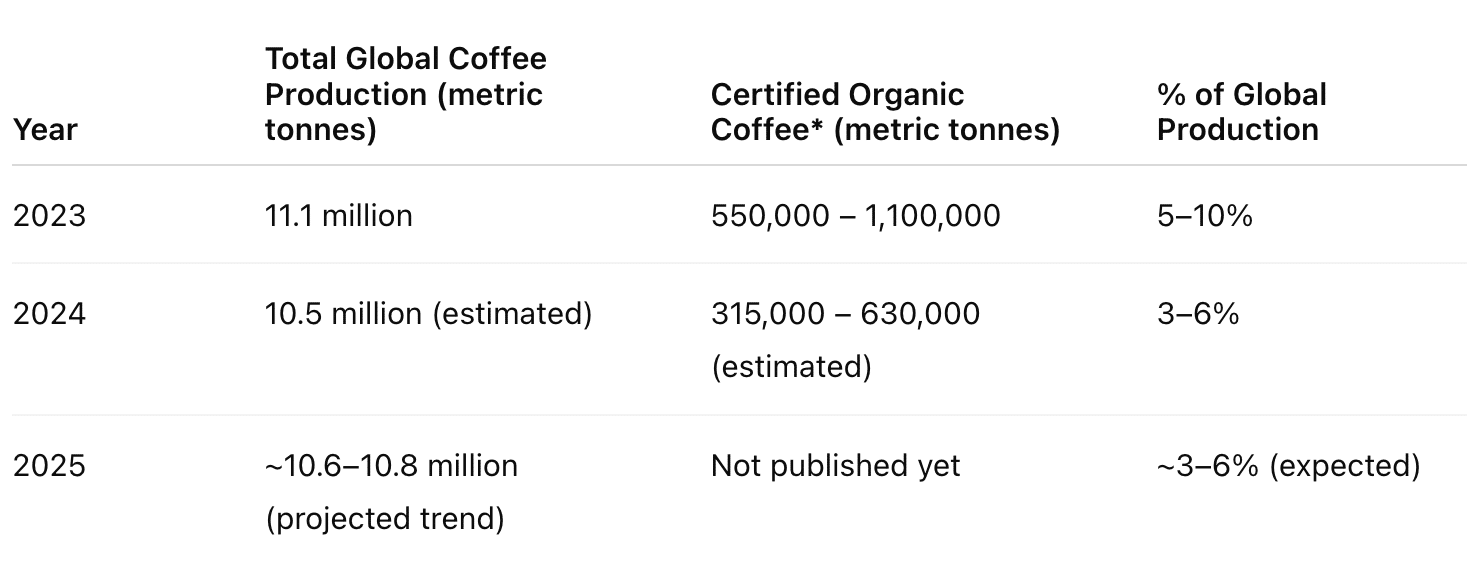

Globally, coffee production reaches approximately 11 million metric tons per year, with certified organic coffee representing only a small share of that total*-typically estimated in the very low single-digit percentages. Despite its modest volume, certified organic coffee plays a key role in premium and specialty markets, where consumers value traceability, sustainability, and chemical-free farming -principles often linked to agroforestry and biodiversity.

Much of this coffee is grown by smallholder farmers in Latin America, Africa, and Southeast Asia, whose traditional methods often align naturally with organic principles. These producers have long supplied the EU’s high-value organic market under a system of equivalency, allowing non-EU countries to certify products using their own national standards, provided they broadly matched EU requirements.

That flexibility ended on October 1, 2025. From that date, all organic coffee imports into the EU must fully comply with EU Organic Regulation (EU) 2018/848. Non-EU producers are now required to meet the same standards as EU-based farmers, covering soil fertility, crop rotation, internal control systems, and the legal structure of producer groups -requirements that often differ from traditional certification practices in origin countries.

For coffee -a crop largely grown outside the EU, this regulatory shift represents a significant moment. Producers previously certified under national systems or private schemes may need to restructure operations, formalise cooperatives, and implement robust compliance systems to maintain access to the EU organic market.

What was once a relatively accessible premium segment is now more structured and regulated. Stricter compliance requirements are affecting supply, increasing operational responsibilities, and influencing sourcing decisions across the entire coffee value chain, from smallholder communities and cooperatives to EU roasters.

These changes represent a clear shift in the certified organic coffee market. While the regulatory updates aim to harmonise standards and protect the integrity of the organic label, they also require adaptation from producers and roasters throughout the value chain.

Key Changes in EU Organic Legislation impacting the coffee value chain

MAIN CHANGES AND THEIR IMPACTS ON COFFEE PRODUCERS

As of October 1, 2025, all organic coffee imports into the EU must comply fully with Regulation (EU) 2018/848. This marks the end of the ‘equivalence’ model, where non-EU producers could certify under their own national systems, and requires them instead to follow exactly the same standards as EU farmers.

Below are the most significant changes and what they mean in practice for coffee producers:

1. End of Equivalence: Full Alignment Now Required

Until now, non-EU producers could export coffee under national organic standards deemed ‘equivalent’ to EU rules. From October 2025, this flexibility disappears. Producers must now comply directly with EU standards, including:

- Strict crop rotation and soil fertility rules

- Prohibition of synthetic inputs (as before)

- Stricter definition of the “production unit” – the entire farm must be certified organic

➤ IMPACT:

The loss of flexibility is especially challenging for smallholders in coffee agroforestry or mixed-farming systems. Practices that once fit under local standards may no longer qualify, forcing producers to adapt methods or risk losing EU organic market access.

2. Who Gets to Be Certified? New Limits on Certification Holders and Group Models

The new regulation reshapes how organic certification is structured in origin countries.

A. Only co-ops and producer associations can hold certificates

Private companies are no longer allowed to hold organic certificates on behalf of farmers. Certification must now rest with cooperatives or legally recognised producer associations – a fundamental shift from the previous system, where exporters often organised and managed supply chains.

B. Stricter rules on group certification

Group certification – long a cornerstone for smallholder coffee farmers – now comes with tighter restrictions:

-

Maximum of 2,000 producers per certified group

Previously, groups could include thousands of farmers. Now, groups must be split into smaller units, which increases the cost and complexity of certification. -

Mixed farms allowed, but mixed groups not allowed

Under the new EU organic regulation, individual organic farmers can operate mixed farms as long as there is clear separation (e.g. organic coffee for export and non-organic crops for local sales).

What is not allowed is for a group of operators to include both organic and non-organic members. This is a major challenge for many certified organic cooperatives that currently have both types of members. -

Transition deadlines

The regulation is already fully applicable in third countries since 1 January 2025. However, the derogation period for import consignments expires on 15 October 2025. After that date, products not certified in full compliance with Regulation (EU) 2018/848 can no longer be imported into Europe as “organic”. -

Individual audits required for farms over 5 hectares or €25,000 in sales

Farmers who exceed these thresholds can no longer be certified as part of a group. Instead, they must undergo a full individual audit – which is often prohibitively expensive.

➤ IMPACT:

The new rules significantly increase administrative and compliance requirements for coffee producers. Some may manage the necessary reorganisation into legal producer associations or smaller groups, but for others, the changes could be a breaking point. Smallholder farmers, particularly in countries without strong cooperative systems or with diverse farming practices, risk being pushed out of the organic sector entirely, which could reduce the availability of certified organic coffee for the EU market.

3. Mandatory Three-Year Transition Period

Previously, producers in remote or ‘clean’ areas without chemical input could sometimes obtain certification after just one year. Under the new regulation, all farms must now undergo a minimum three-year transition period, regardless of history or location before becoming eligible for certification.

➤ IMPACTS INCLUDE:

- Significantly raises the barrier for new farmers or regions to enter the organic market

- Producers must follow organic practices during transition without receiving organic premiums

- Slower return on investment, discouraging expansion of organic coffee

- Agroforestry systems and traditionally ‘organic by default’ farms lose their fast-track path to certification

This blanket rule makes certification more uniform – but also less accessible, and potentially limits the future growth of organic coffee origins.

4. Tighter EU Controls Bring Auditor Shake-Ups & Testing Delays

With the introduction of Regulation (EU) 2021/1378, the rules governing organic coffee certification have tightened significantly – affecting both the certification process and product verification. These changes are already creating bottlenecks and uncertainties across the supply chain.

A. Certification Process – Who can certify?

From 1 January 2025, only control bodies formally recognised by the EU are authorised to certify organic coffee destined for the European market.

This represents a fundamental shift from the previous equivalence system, where national or private certifiers could issue valid certificates as long as they broadly aligned with EU standards. Under the new rules, full compliance with the EU Organic Regulation is required.

This change has also raised the bar for certifiers themselves. During the transition, several established certification bodies faced uncertainty regarding their recognition status. While some ultimately secured EU approval, others were (temporarily) suspended, creating gaps in certification coverage. As a result, many exporters and cooperatives were left in limbo – unable to confirm shipments, sign contracts, or plan effectively during a critical period.

B. Product Verification – stricter, more frequent testing

Organic certification is no longer based solely on documentation and audits – it now hinges just as heavily on direct testing of coffee lots. Residue testing has become more frequent and more precise, with laboratories using advanced technology to detect even trace amounts of contamination.

To obtain or maintain certification, companies must:

- Regularly sample their coffee lots

- Send those samples to EU-accredited laboratories

- Wait one to two weeks for results

These tests are mandatory for passing audits conducted by recognised control bodies.

While this strengthens the integrity of certified organic coffee, it also introduces delays, administrative burdens, and higher costs – pressures that fall disproportionately on smallholder-based supply chains.

➤ IMPACTS INCLUDE:

- Certification disruptions have created bottlenecks across the supply chain

- Cash flow is constrained, as producers cannot invoice or ship coffee while awaiting lab results

- In volatile markets, the 1–2 week delay may force producers to skip certification altogether in order to sell quickly and secure pricing

- Testing and admin costs are eating into already thin margins

- The constant need to prove organic status at every stage makes it increasingly difficult for smallholder-led supply chains to remain compliant – or even operational – under the new EU rule

5. Rising Costs, Shrinking Supply & a Market Shift away from Europe

The cumulative effect of the new EU organic regulations is increasing complexity, costs, and risks across the coffee value chain – especially for smallholder cooperatives.

Global Impact

Smallholder cooperatives face higher administrative burdens and compliance costs, including investments in infrastructure, training, testing, and documentation. Farms exceeding certain size or sales thresholds must undergo individual audits, while group certification rules now limit the number of producers per certified group. These requirements disproportionately affect smallholders, putting the supply of certified organic coffee at risk.

Market Consequences

Limited supply of certified organic coffee has significantly affected market dynamics. Organic coffee, which was sometimes undervalued in the past, is now commanding higher premium prices due to scarcity and stricter compliance requirements.

Some exporters may consider alternative markets with less demanding regulations, but trade barriers, logistics, and market demand influence such decisions. The reduced availability of certified organic coffee in Europe has created both price pressures and supply constraints, impacting the entire value chain.

European Market Impact

The combination of limited supply, stricter compliance, and regulatory transition requirements has intensified price and supply pressures across Europe. Smallholder margins are squeezed, and availability of certain coffee qualities may be affected. Producers must carefully manage certification and sourcing to maintain reliable supply for European buyers, while some may explore markets with fewer regulatory hurdles.

MAIN CHANGES AND THEIR IMPACTS ON EU COFFEE ROASTERS

With the new EU organic regulations, organic coffee roasters face important strategic decisions:

Brand Philosophy

- What does “organic” mean for your brand?

- Do you require the EU organic logo on your packaging, or is your focus on a broader philosophy emphasising clean farming, biodiversity, and sustainable practices -even if the coffee is not yet certified under the stricter EU rules?

Sourcing Viability

- Is your current sourcing model still viable?

- Some origins or producers may lose certification under the new rules, and availability of certified organic lots may fluctuate.

- Build flexibility into your sourcing portfolio to manage potential disruptions.

Supplier Due Diligence

- Who are you buying from? Partner with suppliers, cooperatives, and exporters who understand the new EU rules and can help you navigate compliance.

- Ask about certification bodies, farmer group structures, and testing procedures to ensure consistent supply.

By reflecting on these questions, coffee roasters can develop proactive strategies to navigate the evolving EU organic coffee landscape, protecting both supply chains and brand integrity.

HOW EFICO CAN HELP

EFICO is your green coffee partner, helping you secure reliable supply:

-

Certified Organic Coffee – fully compliant with EU rules.

-

‘Organic by Nature’ Coffee – sustainable, chemical-free practices.

-

Conventional Coffee – premium quality, consistent sourcing.

EFICO Certified Organic Portfolio:

-

Robusta: India

-

Arabica: Central America (Peru, Honduras, Mexico, Nicaragua) & Ethiopia

Secure Your Organic Coffee Supply Today – Contact our green traders to discuss how to navigate the evolving landscape and maintain a consistent, sustainable supply.