UGANDA & THE RISE OF ROBUSTA

FROM THE SOURCE OF THE NILE TO YOUR ROASTERY

FROM THE SOURCE OF THE NILE TO YOUR ROASTERY

Each year, EFICO opens the season with a field report drawn from a Green Coffee Trader Trip -an opportunity to step closer to the origins, communities, and landscapes that shape the coffees we trade.

As 2025 came to a close, our green coffee traders returned to Uganda for the second consecutive year, engaging directly with the country’s coffee ecosystem and the green coffee partners behind. The visit delivered concrete harvest updates, market context, field-level insights, and forward-looking signals -forming the backbone of our first origin focus of the year.

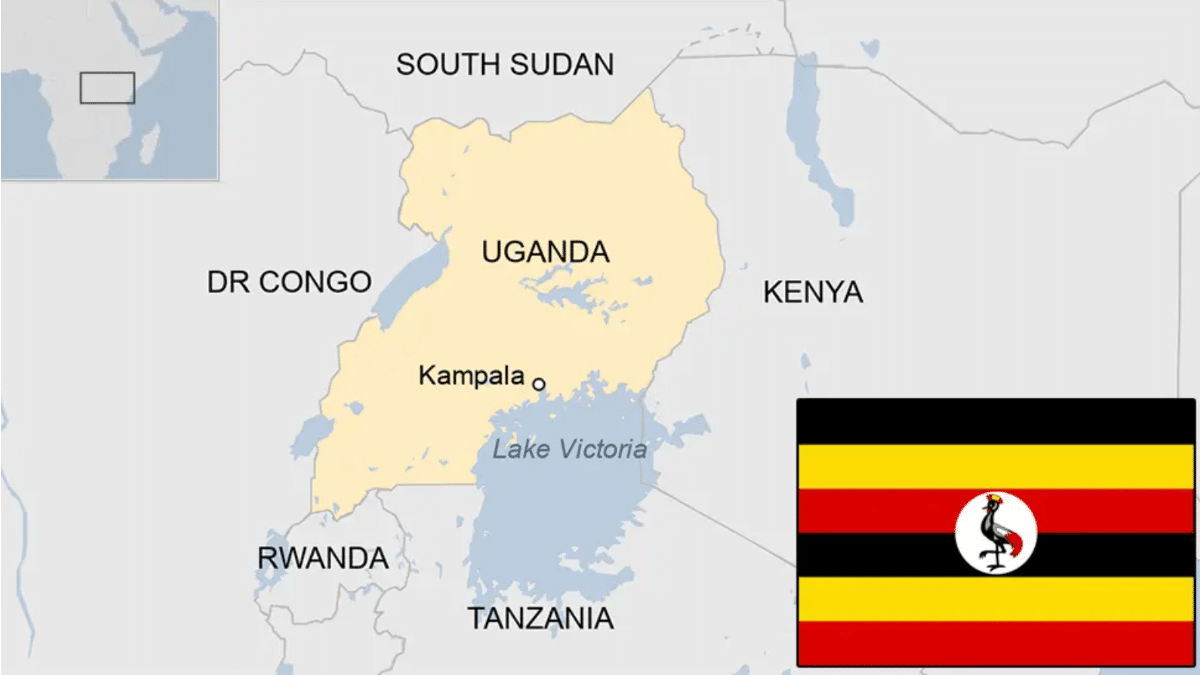

UGANDA COFFEE SNAPSHOT

-

Coffee directly supports the livelihoods of roughly 3.5 million smallholder farmers, most cultivating less than one hectare. Cooperatives and farmer groups play a key role in aggregation, extension, and quality improvement.

-

Coffee is Uganda’s largest agricultural export and ranks second overall after gold, contributing 10-15% of total export value depending on the year.

-

Uganda is the ancestral home of Robusta coffee, with indigenous varieties such as Nganda and Erecta still thriving in forests around Lake Victoria. Robusta accounts for 80% of national coffee production, making Uganda the largest Robusta producer in Africa.

-

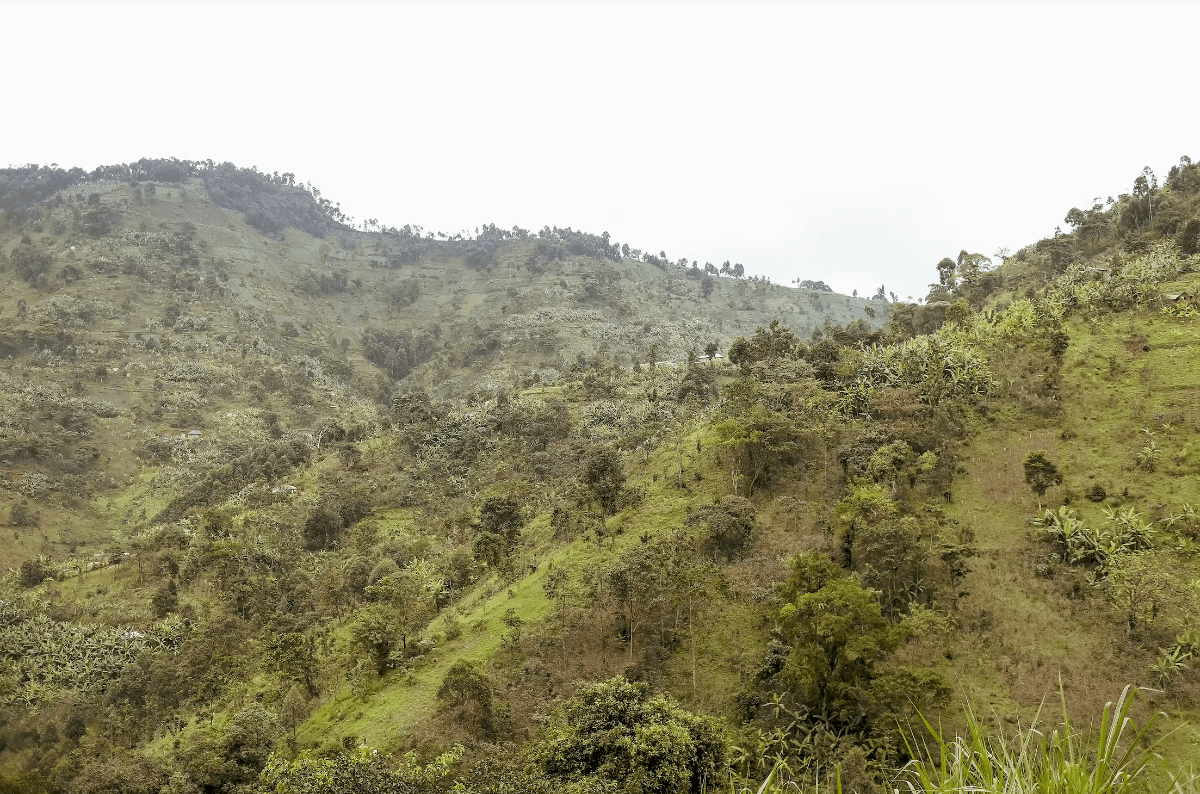

Arabica, introduced from Ethiopia, grows in select highland regions such as Mount Elgon, the Rwenzori Mountains, and Mount Muhabura. Specialty Arabica lots are emerging but remain a small fraction of total output.

-

Many farms grow coffee under the shade of native trees, creating stable microclimates that protect cherries, support biodiversity, and reduce the need for chemical inputs. Trees are resilient, consistently productive, and require minimal intervention.

-

Uganda benefits from two rainy seasons, allowing two annual harvests -typically March to June and September to November. This staggered schedule ensures a steady, year-round supply while soil moisture supports tree health and consistent yields.

Jean Lauwers, EFICO senior green coffee trader and trained agronomist: “Uganda’s coffee stands out in Africa: Robusta, grown in its ancestral and endemic environment, forms the backbone of the country’s production and is the largest in the continent. While Arabica -introduced from Ethiopia, thrives in select highland regions and produces some specialty lots, it represents only a small fraction of output. Smallholders drive both quality and supply, and two annual harvests provide stability for farmers and buyers alike. Combined with shade-grown, low-input systems, Uganda demonstrates that resilience, sustainability, and consistent supply coexist -making it a noteworthy and interesting origin for Robusta Coffee.”

UGANDA’S QUIET RISE ON THE AFRICAN COFFEE MAP

- For decades, Ethiopia dominated the global perception of African coffee, celebrated for its heirloom Arabica varieties and deeply rooted coffee culture. Uganda’s ascent followed a different, less publicised path -one driven not by tradition alone, but by structural reform, scale, and strategic investment.

- A turning point came in the early 1990s, when Uganda fully liberalised its coffee sector. The dismantling of state controls between 1991 and 1992 ended fixed pricing, centralised purchasing, and export restrictions. Farmers gained direct access to international markets, competition increased across the value chain, and private exporters and processors began to invest more actively -particularly in the Central Region. This shift laid the foundation for sustained production growth and stronger export performance.

- Momentum accelerated in 2013 with the launch of a national coffee replanting program led by the Uganda Coffee Development Authority (UCDA) and supported by Operation Wealth Creation (OWC). Millions of free seedlings were distributed nationwide, backed by an extensive public awareness campaign spanning radio, television, and digital platforms. Crucially, the program went beyond individual farmers, engaging traditional kingdoms* -such as Buganda, Ankole, Tooro, Bunyoro, and Busoga, as well as faith-based institutions with access to land.

- Favourable global market conditions reinforced these efforts. Rising coffee prices from 2013 onward, culminating in sharp increases between 2023 and 2025 –improved farm gate profitability and strengthened farmers’ incentives to reinvest in coffee. Combined with liberalised trade, replanting initiatives, and institutional engagement, these dynamics reshaped Uganda’s role in the global coffee supply chain.

Today, Uganda’s position reflects a structural transformation rather than a sudden breakthrough -marking its emergence as one of Africa’s most reliable and scalable coffee origins.

Jérémie Trono, EFICO senior green coffee trader : “Through policy reform, replanting, and sustained farmer engagement, Uganda has strengthened both supply and quality. For green coffee buyers like EFICO, it represents a resilient, dependable origin with a unique Robusta heritage and growing Arabica potential -and one where we actively partner with local cooperatives and farmer groups to support lasting, trustworthy projects on the ground.”

UGANDA COFFEE EXPORTS 2025: A YEAR THAT REFINED THE MARKET

Uganda’s 2025 coffee exports set new records across volume, revenue, and global reach, reflecting a combination of strong harvests, improved quality, and rising international demand.

- Record-Breaking Exports: 8.4 million 60 kg bags (≈504,000 t), surpassing Ethiopia’s 7.82 million bags.

- Historic Single-Month Performance: September 2025 saw 844,949 bags exported -the largest single-month total in Uganda’s history.

- Revenue Growth: Export earnings reached $2.4 billion (≈UGX 8.2 trillion), up 64% year-on-year; export volume rose 30%.

- Coffee Composition: Robusta dominates over 85% of output. Arabica exports more than doubled in value, driven by high-altitude regions improving quality for specialty markets.

- Primary Markets: Uganda’s coffee export market remained in Europe, accounting for 63 % of all exports, with Italy as the biggest importer of Ugandan coffee, accounting for 26.22 % of shipments, followed by Germany (10.67%), Algeria (7.49%), India (6.62%), and Switzerland (4.94%). The top 10 destinations took 74.66% of the shipments.

- Intra-Africa Trade & Key African Buyers: In 2025, Uganda exported about 15–25% of its coffee to African countries, including Sudan, Algeria, Morocco, Egypt, South Africa, Tunisia, Kenya, and Senegal, reflecting growing regional demand and stronger intra‑African trade links.

- Asian Markets:

Surging demand from Asian markets like China and India for premium beans, boosted by trade initiatives like the Uganda-China partnership and presence at expos like Specialty Coffee Expo Japan.

Jéremie explains: “the rise of Uganda coffee exports in 2025 wasn’t an accident. Several critical factors converged to make this the nation’s most successful year ever: While Uganda has long been the king of African Robusta, 2025 saw a dramatic surge in Arabica exports, which more than doubled. High-altitude regions like Mt. Elgon and the Rwenzori Mountains benefited from improved washing stations and quality control, making Ugandan Arabica a highly sought-after commodity in specialty markets like Italy and Germany.”

UGANDA 2025/2026 HARVEST OUTLOOK

- Slightly Larger Crop – Stable Quality:

- Uganda’s 2025/26 Robusta main crop is underway, with farmers reporting a slightly larger yield than last year.

- Quality risks remain minimal, with expectations for clean, consistent lots across major producing regions.

- Positive field dynamics reflect growing investment by farmers in fertiliser application, gap filling, and higher tree density, which could boost future yields.

- Harvest Timing & Regional Progress:

- Farmers are expected to continue harvesting into mid- to late January 2026, while the fly crop is projected April-August 2026, assuming normal weather patterns.

- A full assessment of annual production will depend on the 2026 main crop evaluation starting in March.

- Climatic Conditions & Challenges

- Long-term risks include hotter, drier conditions due to climate change, with projected 1.7–1.8°C temperature rise by mid-century and increasingly erratic rainfall.

- Pest pressures, such as coffee berry borer and leaf rust, are rising.

- Adaptation efforts include agroforestry, climate-smart agriculture, and resilient varieties, though uptake is uneven due to limited finance and input access.

- Regulatory & Market Factors:

- The Uganda Coffee Development Authority (UCDA) now operates under the Ministry of Agriculture following a 2025 structural change, representing a shift in oversight.

- Upcoming general and presidential elections (January 2026) may temporarily slow export logistics but are unlikely to impact long-term production.

- Uganda is ready for the EU Deforestation Regulation (EUDR) and other due diligence requirements.

- The Task Force National Action Plan focuses on compliance and building resilient, accountable supply chains.

- Farmers are being registered, and a national coffee data warehouse is being established to support transparency.

- EFICO is already offering EUDR-compliant lots, ensuring supply chain continuity.

- Market Outlook & Opportunities:

- Uganda’s reliability, year-round availability, and diversity of cup profiles make it increasingly attractive to global buyers amid climate disruption and supply chain fragility.

- The growing farmer investment in farm management and adoption of climate-smart practices supports future yield stability and quality improvements.

EFICO’s Jéremie Trono concludes: “Overall, the 2025/26 harvest is slightly larger with stable quality, showing healthy field dynamics. Despite climate and regulatory challenges, Uganda is positioning itself as a resilient, reliable supplier in both commodity and specialty markets, with strong potential for growth in coming years.”

EFICO’S UGANDAN GREEN COFFEE PORTFOLIO

Robusta today represents roughly 40% of global coffee production, and its role in modern roasting is being reassessed. Across Europe, roasters are increasingly valuing Robusta not only for its functional strengths, but for its cup character, resilience, and strategic importance. When cultivated and processed with care, Ugandan Robusta offers structure, intensity, and consistency -delivering excellent crema and body in espresso, reliable flavour performance in blends, and growing appeal as a distinctive single-origin coffee.

“The focus has shifted from utility to expression,” explains EFICO green coffee trader Thomas Hertog. “Our quality Ugandan Robusta shows clarity and depth in the cup. Its naturally lower acidity and higher caffeine content make it exceptionally well suited to espresso, where it enhances texture, balance, and crema -whether supporting a blend or standing confidently on its own.”

“EFICO’s Ugandan green coffee portfolio reflects this evolution by combining the best of both varieties. Aromatic, high-altitude Arabica and robust, characterful Robusta,” notes Jérémie Trono. “Both varieties are cultivated with care, often under Organic or Fairtrade Organic certifications, and fully aligned with EU Deforestation Regulation (EUDR) requirements -ensuring traceable, responsible sourcing across the supply chain.”

Jean Lauwers concludes: “The main harvest is slightly delayed but already sailing, with availability expected in our European warehouses by April. We strongly encourage roasters to prebook their preferred qualities. Our Green Coffee Trade team is available to advise on profiles, check availabilities, or arrange sample requests.”

CREDITS, KUDO’s & REFERENCES

* Buganda, Ankole, Tooro, Bunyoro, and Busoga are historical Bantu kingdoms in present-day Uganda, significant for their rich cultural heritage, traditional monarchies (Kabaka for Buganda, Omukama for others), and roles within the British Protectorate, with most being abolished in 1967 but later restored as cultural institutions under the Ugandan Constitution. They represent major ethnic groups, like the Baganda, Banyoro, Batooro, Banyankole, and Basoga, each with unique traditions and rulers, forming key parts of Uganda’s diverse cultural landscape.

World Bank Group – Restructuring Uganda’s Coffee Industry

Uganda Coffee Development Authority (UCDA)

ILO – Mapping the coffee value chain in Uganda

World Coffee Research – Road map for prioritized investment in Uganda coffee R&D & seed systems

Nile Post – Uganda surpasses Ethiopia to become Africa’s Top Coffee Exporter

Bioeconomics Working Paper Series – Private Sustainability Standards in the Ugandan Coffee Sector: Empty Promises or Catalysts for Development?